Mission-Based Budget Model

Updated Nov. 18, 2025

Understanding UC Irvine’s Budget Model for Core Funds

Budgeting and financial planning are critical tools for strategic planning and resource management. A well-designed budget model facilitates the distribution of core financial resources in support of UC Irvine’s mission and long-term goals. Prior to FY25, the university used an incremental budget model, in which annual budgets were based on the previous year’s allocation, with adjustments for cost increases, new initiatives, or necessary reductions. Incremental models for academic activities often lack transparency around the rationale for historical allocations, can be inflexible, and may not align well with current operating needs and strategic initiatives.

In FY25, UC Irvine transitioned to a mission-based budget model that is formula driven for allocating core resources to schools. The model determines resource distribution of core funds, including state appropriation, tuition, non-resident supplemental tuition, indirect cost recovery, professional degree supplemental tuition, summer session, student services fees, and various unrestricted sources. The metrics that are defined for the model link funding more directly to the university’s core priorities—teaching, research, and public service.

The budget model for all other divisions (non-schools) will continue to be an incremental model through fiscal year 2025-26.

Improved Budgeting & Financial Planning

The mission-based budget model allocates core funds consistent with actual revenues and aligned with strategic priorities. While core funds are the focus of the model, implementation of the mission-based budget model will be supported by all funds multi-year planning—a more holistic approach that considers all available resources and is informed by multi-year forecasts and scenario analyses.

Budget Model Goals:

Data Driven

Funding drivers are based on key metrics that align with UC Irvine's strategic plan to support well-informed, data-driven decision making.

Predictable

Campus planning assumptions are shared and projected resources can be modeled to establish a clear rationale for budgets and greater predictability.

Transparent

More information and data is provided to improve transparency in decisions and strategic direction.

Holistic

All funds multi-year planning provides a more holistic perspective, highlighting opportunities to leverage non-core sources to support strategic goals.

Address Funding Gap

These goals combined with budget principles work towards building a comprehensive plan for addressing the funding gap.

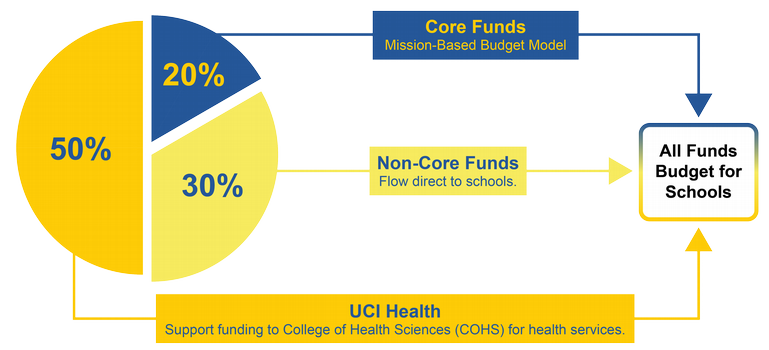

All Funds Overview

UC Irvine’s operating budget is over $6 billion and is supported by a variety of funding sources. The mission-based model focuses on core funds. To effectively manage operations, schools must consider all available resources—not just core funds. Additional funding sources may include contracts & grants, clinical revenues, philanthropy, and more. The graphic below provides a high-level overview of how core and non-core funds impact planning. For a full breakdown of UC Irvine’s funding sources and how they support the university’s operations, visit the Financial Stability Plan webpage.

All Funds Operating Budget

Funds Flow to Schools

The mission-based budget model allocates core funds to schools that are distributed based on key drivers that reflect faculty investments, student instruction and services, and research activity.

The model is not solely intended to support activities tied to the specific metrics; rather, it provides a framework for determining the total core resources available to each school. Within the context of overall campus goals, schools are responsible for establishing school-level budgets that reflect their unique strategies, priorities, and costs. Decisions on fund distribution to departments are best made by school leadership and other stakeholders based on the needs and goals of the individual schools.

Click the boxes below for more information. For the best experience, use Chrome or Firefox.

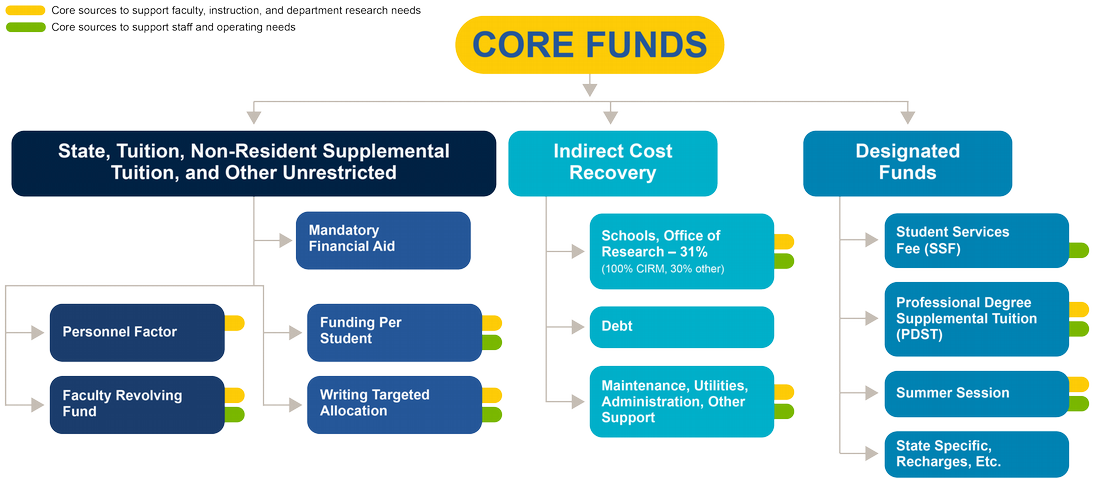

Core Funds

Core funds support the university's core mission of teaching, research, and public service and are comprised of tuition and fees, the state appropriation, indirect cost recovery, investment earnings, other unrestricted resources, and funds designated for specific programs.

State, Tuition, Non-Resident Supplemental Tuition, and Other Unrestricted

Annual State of California appropriation (see the California State Budget), tuition, non-resident supplemental tuition (NRST), and other unrestricted resources (e.g. investment earnings, general and administrative assessment, ground lease revenues).

Mandatory Financial Aid

In accordance with Regents Policy 3101, a portion of tuition and nonresident supplemental tuition revenue is reserved for need-based student financial aid, a practice called return-to-aid (RTA).

Personnel Factor

Together with the funding per student factor and the faculty revolving fund, the personnel factor provides a base campus investment in support of the teaching, research and service mission. The faculty investment factor is defined as 70% of each school’s average faculty salary and benefits; this amount is one contributor to covering the cost of faculty / staff / operating needs with the remaining costs covered through other components of the mission-based budget model (e.g., student metric-based, designated sources, ICR, non-core sources).

The calculation is as follows:

Budgeted faculty full time equivalent (FTE) × (average school S&B) * 70%

The data used is per the December snapshot of budgeted FTE and salaries. Benefits are calculated at Composite Benefit Rates (CBR). More information on CBR is available at Accounting & Fiscal Services website and Office of Research website.

Faculty Revolving Fund

Incremental allocations representing open faculty position funding and other strategic faculty investments, calculated as follows:

Initial allocation ± increments1 = ending balance.

1Increments include merits, promotions, new campus-funded FTE, funding withdrawals on separation, transfers to/from other schools.

Funding per Student (Instruction & Operating)

School-specific rate × weighted student FTE.

The school-specific rates per student were established to recognize that the cost of instruction varies from one discipline to the next. The differential rates were established based on an analysis of two factors: prior budget levels as a proxy for instructional needs and benchmark data from a national study on instruction costs by discipline. Each school’s respective rate per weighted student FTE will be adjusted each year to reflect core funding factors like tuition rate increases and state funding changes.

Weighted student FTE are calculated as follows:

- 2-year rolling averages for both student credit hour and enrollment data based on prior year and current year fall data converted to 3 term average (3TA) estimate.

- Degree data is based on the rolling average of the prior two years. Degrees are measured from Fall through Summer.

- Student credit hours (SCH) are based on the payroll home department method where credit is attributed to the home department of the instructor.

- The calculations to convert SCH to FTE are:

- undergrad: annual SCH ÷ 45

- grad (excluding law): annual SCH ÷ 36

- law (on semesters): annual SCH ÷ 24

- Student metrics are weighted as follows:

- 80% student credit hours (SCH)

- 10% enrollment

- 10% degrees granted

$ per student are the same for undergraduate and graduate students.

Writing Targeted Allocation

An annual allocation per student FTE is provided and inflation adjusted each year. Student FTE is calculated based on the projected number of composition and academic English sections times units per course and multiplied by estimated enrollments to determine student credit hours (SCH). SCH are divided by 45 to convert to FTE.

Indirect Cost Recovery (ICR)

Funds generated as a result of research expenditures that help cover costs for maintenance, utilities, administration, and other research-related support.

Debt

Financing to fund university capital projects. Indirect cost recovery from grants and contracts is used to fund debt repayment for academic/research buildings.

Schools, Office of Research

Schools and the Office of Research receive 30% of their indirect costs (IDC) related to research managed in their respective units. Grants from the California Institute of Regenerative Medicine (CIRM) are an exception in that administrative funds flow directly to the Stem Cell Center and facilities funds are allocated directly to maintenance and utilities of affiliated space.

Maintenance, Utilities, Administration, Other Support

Maintenance, utilities, administration, and other support are costs that are unallowable as direct expenses on grants and contracts but are essential in sustaining and supporting the research enterprise.

Designated Funds (State specific allocations, program-specific student fees)

Targeted allocations from the state (e.g., student academic preparation and educational partnerships (SAPEP) outreach programs, basic needs, student mental health, financial aid, etc.), professional degree supplemental tuition (PDST), student services fee (SSF), and summer session.

Student Services Fee (SSF)

A mandatory systemwide fee for all registered students, used to support co-curricular programs, activities, and services that complement the academic experience.

Professional Degree Supplemental Tuition (PDST)

Additional amount paid by students enrolled in professional degree programs to support instruction and specifically to sustain and enhance program quality. The charges vary by program.

Summer Session

Summer Session is an opportunity for schools to offer and for students to take courses outside of the normal fall, winter, and spring quarters of the academic year. These might be strategic offerings of high demand courses or opportunities for students to complete requirements more quickly. A portion of net revenues is distributed to schools offering the courses.

State Specific, Recharges, Etc.

State specific allocations are targeted allocations from the state to fund student academic preparation and educational partnerships (SAPEP) outreach programs, basic needs, student mental health, financial aid, etc.

Recharges are costs charged to a university department, unit, activity, or project for specific goods or services provided by another university department/unit/activity/project.

Non-Schools

Support unit budgets continue to be incremental through 2025-26. Mission-based budget model options will be evaluated in 2025-26 for implementation as early as FY27. The focus is to define distribution logic for research-related indirect cost recovery (ICR) and for general & administrative assessment funds collected to offset indirect costs from services and support to auxiliary, health/medical center, and self-supporting activities. The budget call for FY27 will also request additional information on department level activities to better understand the operations and priorities of each support unit. The latter will inform incremental budget adjustments that will continue for other fund sources (state/tuition/other unrestricted).

Final Model for Schools (FY26) Compared to the Draft Framework (FY25)

Recognizing that no model is perfect, updates were made to the budget model based on feedback to better align with a mission-based approach. Please see the comparison chart below for an overview of key changes and considerations.

| Budget Model Components | Draft Framework (FY25) | Final Model (FY26) | Improvements Based on Feedback |

|---|---|---|---|

| Fund Buckets |

|

|

Combined state, tuition, NRST, and other unrestricted into a single pool, reducing dependency on any one source and spreading impact across all distributions. |

| Faculty Funding Changes Pool | n/a | Faculty Revolving Fund | This fund pool builds on the prior approach to open faculty positions. As of 7/1/2024, the initial allocation provides flexible funding (12% of filled faculty funding for most schools) for recruitment, retention, temporary instruction, and other needs. Managed centrally within each school, it bridges short-term funding gaps until the model’s faculty full-time equivalent (FTE) driver fully kicks in. It also tracks key allocations and school-to-school funding transfers. |

| Personnel Factor |

|

70% of Faculty Salaries and Benefits | Replaces eight complex personnel factors with a single factor set to 70% of each school’s average faculty salary and benefits, reflecting campus investment in teaching, research, and service. These funds, along with the other mission-based budget model components (e.g., student metric-based and other core and non-core sources), are intended to cover faculty, staff and operating costs. |

| Funding Per Student (cost of instruction) | Cost of instruction supplement. | Differential funding per student that is +/- the average; targeted allocation for writing. | Recognizing that the cost of instruction is very different across the disciplines, benchmarking metrics were sought to inform existing budgets. An initial funding rate per student FTE was established for each school informed by the prior empirical budget and a national study on the cost of instruction productivity (NSCIP) for AAUs as benchmarks. Rates will adjust annually for tuition, NRST, and other fund shifts. The updated model addresses most cost differences through the faculty investment factor. The campus writing program will receive a targeted allocation that is not effectively addressed via other metrics. |

| Calculation of Weighted Student FTE in the Funding Per Student Factor | Weighted Student FTE:

|

Weighted Student FTE:

|

Student credit hours now include all undergraduate and graduate students at a higher weight. Enrollment (majors) and degrees granted weights were reduced to avoid upper-division duplication. Small weights were retained to reflect student services and advising needs, as well as, emphasize degree completion. Note: The payroll home department method for calculating student credit hours is used in both versions. |

| Designated Funds | Targeted allocations going directly to schools. | Represent restricted and other targeted resources that will remain the same. | PDST, summer session, and targeted state programs like SAPEP outreach, basic needs, student mental health, and financial aid remain unchanged in the model. Student services fee (SSF) amounts include an allocation per enrolled student + targeted allocations (as recommended by the campus student fee advisory committee and approved by the provost). |